On March 31, a 44-year-old man from Best was arrested and taken to a police station in Eindhoven for questioning. Authorities suspect the man of being directly involved in a case of tax fraud connected to his company.

Searches were conducted at:

- His residence

- Two business premises located in Eersel and Eindhoven

During the searches, investigators seized financial documents, digital records, and data carriers relevant to the ongoing investigation.

Case Originated from Tax Authority Audits

The criminal inquiry stems from audits carried out by the Dutch Tax and Customs Administration. Preliminary findings suggest that fraudulent activities were intended to avoid additional tax assessments, which may have led to a substantial loss in tax revenue.

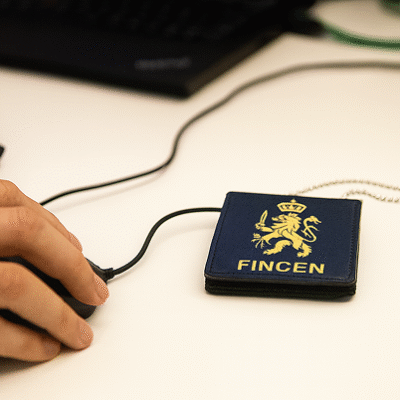

Oversight and Broader Context

The case is being handled under the direction of the Public Prosecution Service, which oversees financial crime enforcement.

Why Tax Compliance Matters

The tax system relies on the accuracy and honesty of citizens and businesses. Deliberate misreporting or manipulation not only causes financial damage to the state but also erodes public trust in the fairness of the system. Ensuring proper compliance is essential to maintaining the integrity and sustainability of public services.s legal business, distorts fair competition, and enables broader criminal operations to remain hidden. Effective prevention and prosecution are vital for protecting the integrity of financial systems.