On Wednesday, May 21, investigative authorities took action in two related financial crime cases in Deventer, resulting in the arrest of three men aged 41, 42, and 46. The individuals are under investigation for suspected fraudulent activities linked to the collapse of multiple businesses.

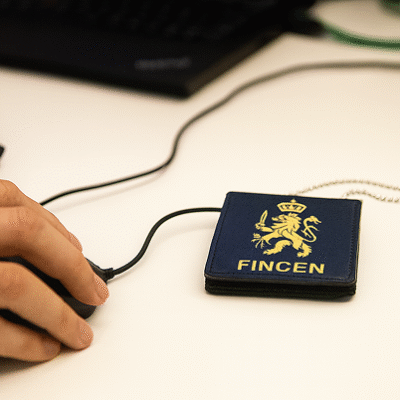

During the operation, officials from the FINCEN carried out a search at a commercial property in Deventer. Key administrative records were seized along with three high-end vehicles. The arrests and search stem from an investigation initiated after a court-appointed trustee filed a complaint regarding the financial handling of two recently bankrupted companies.

Questionable Loans and Support Claims

The 42- and 46-year-old suspects had successively held director positions at a company and its holding structure, both of which were declared insolvent within a short span. Prior to the collapse, over one million euros in unrecoverable loans were issued to the 42-year-old, including funds used for personal benefit. Furthermore, there are strong indications that the company in question received excessive government wage support (NOW scheme) under potentially false pretenses.

Business Transfer and Concealed Liabilities

Evidence also suggests that shortly before the bankruptcies, key business operations were shifted to a new company—believed to have been established solely to shield assets. This move left behind considerable outstanding debts and cut off creditors from any possibility of repayment. Additionally, a commercial property tied to the companies’ assets was sold to the 41-year-old suspect, who is also under scrutiny for his role as a director and shareholder in multiple businesses.

The investigation is being coordinated by the Functional Public Prosecution Service, which focuses on tackling economic and financial violations.

Why It Matters: Safeguarding Business Trust

Irregularities involving company insolvency can severely damage trust in the marketplace. Abuse of the financial and legal system not only distorts fair competition but also undermines the foundations of responsible business conduct. Addressing this kind of misconduct is vital to protect legitimate enterprises and preserve public confidence in the economic system.